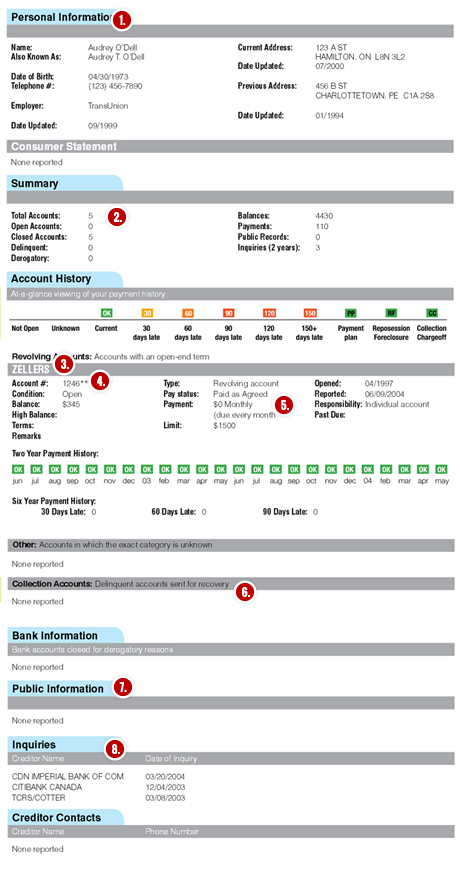

Analyzing Your Credit Report

Lenders base underwriting decisions on the content of your credit report along with the value of your Credit score. Rebuilding credit will improve your scores Optimizing your score involves a thoughtful reshaping of the content of your credit report; the number of trade-lines, current account balances, and the mix of credit types can have a dramatic impact, yet without proper attention this potential remains untapped.

Fixing Credit is only half the job

With your paid membership we will provide you with 12 months of credit analysis, your file continually to insure and monitor changes and revisions have taken effect. after all there is no sense in removing errors and mistakes if your score is not going to change.