Debt Services

Is your bad credit catching up to you? Are you sick of the collectors calling, and harassing you and your family? Our Partners can help you make it stop NOW!

Debt Services for Everyone.

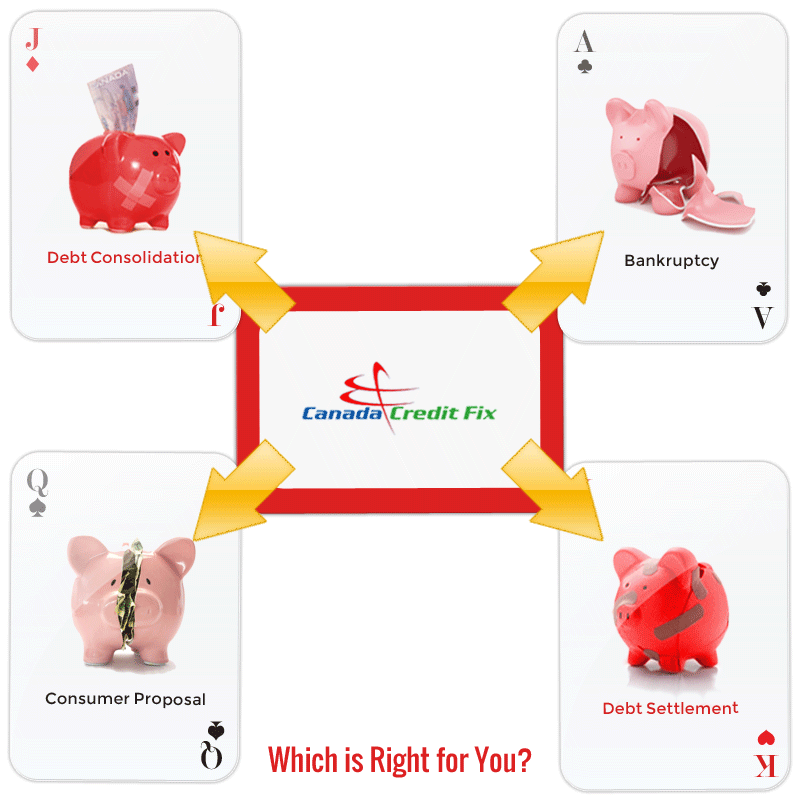

We can give you the facts you need, so that you can make the right decisions when it comes to your debts! You have debt options and may be able to avoid bankruptcy! Debt Settlement, Debt Consolidations, Orderly Payment of Debt, Consumer Proposals and bankruptcy services are all available through partners. One size does NOT fit all when it comes to your credit and debt matters. Let us point you in the right direction!

Best of all Canada Credit Fix is 100% Canadian owned and has offices in Canada. All of our partners have office in most Canadian cities to help service your debt solutions better.

Types of Settlements:

Our Partners can stop the harassing phone calls and help get you back on your feet. Reduce your monthly payments, and make life affordable once again. Our experts will monitor and manage your credit while you are in the process of restructuring your debts. Once you have completed your debt settlement program, we will be there to help you rebuild new, healthy and responsible credit. Call us today and find out your best debt settlement option.